What is Sharevest?

Our platform enables companies to grow to manage multiple investment rounds, while investors can find, and invest in business.

Sharechain blockchain means we can transfer stocks in real time and automate the processing of fully compliant documents.

Our equity-backed tokens and electronic stock certificates make stock transfers between two parties, fast, transparent and trustworthy.

Check out the Videos below:

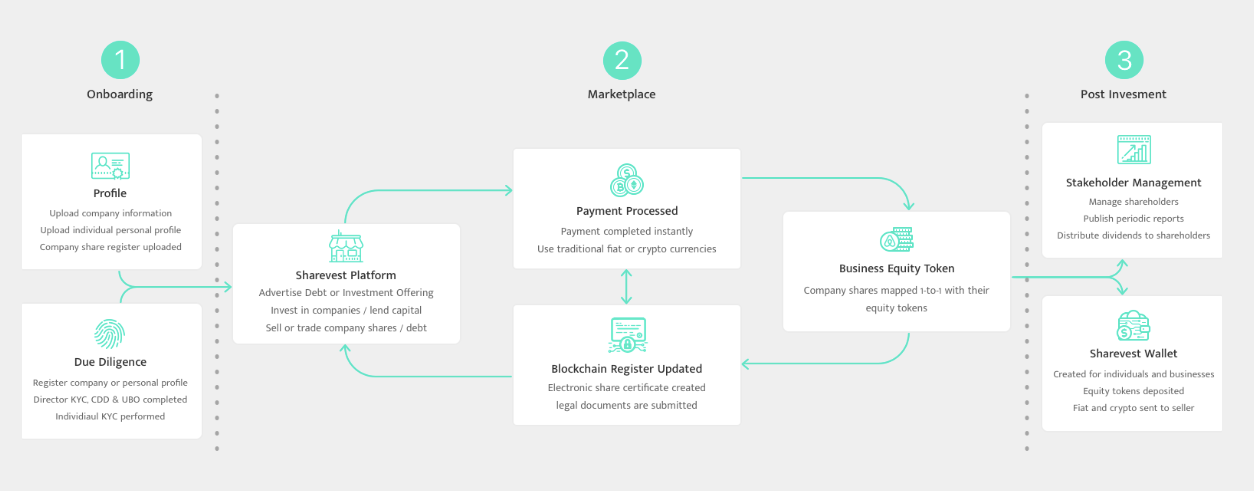

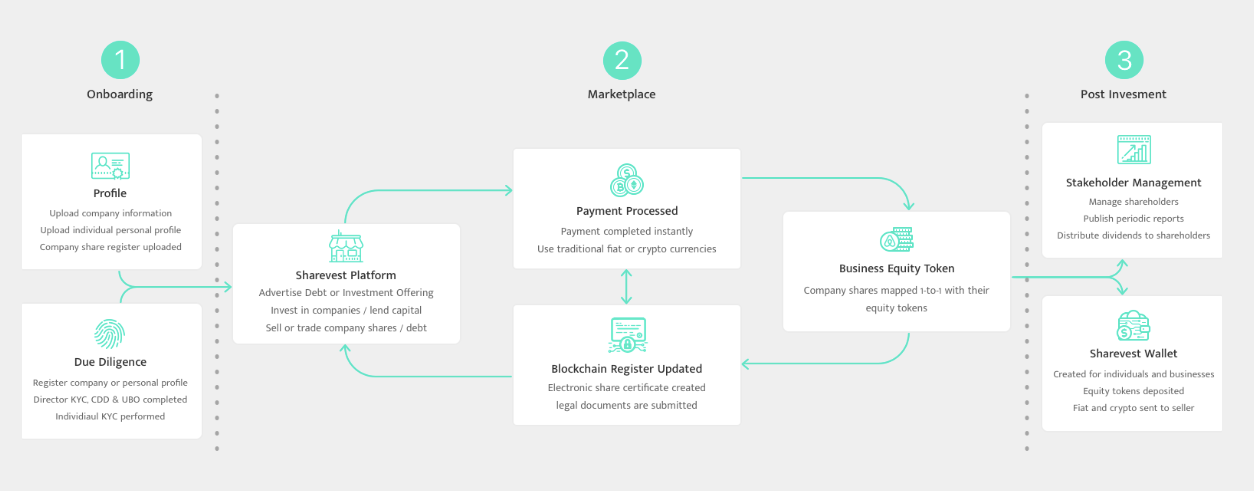

How does Sharevest work?

Sharevest is very unique in pioneering the first global exchange that allows you to buy, sell, or trade stock ownership in the same place, whenever providing instant liquidity for the private market. Sharevest provides the founders and shareholders with a platform from which they can introduce their company and its value. The Sharevest platform creates liquidity in the primary and secondary markets in building a central platform for business owners, shareholders and investors. This platform combines the best of crowdfunding, peer to peer lending and public market trading. Sharevest also uses blockchain technology to enable instant transactions, low transfer fees and infinite investment with minimal bureaucracy. Investors will be able to buy into the company through fiat and cryptocurrency. Like this how it works:

Sharevest is very unique in pioneering the first global exchange that allows you to buy, sell, or trade stock ownership in the same place, whenever providing instant liquidity for the private market. Sharevest provides the founders and shareholders with a platform from which they can introduce their company and its value. The Sharevest platform creates liquidity in the primary and secondary markets in building a central platform for business owners, shareholders and investors. This platform combines the best of crowdfunding, peer to peer lending and public market trading. Sharevest also uses blockchain technology to enable instant transactions, low transfer fees and infinite investment with minimal bureaucracy. Investors will be able to buy into the company through fiat and cryptocurrency. Like this how it works:

Why do you need Sharevest?

- Our goal at Sharevest is to develop a financial ecosystem that will support the company through all stages of their life cycle.

- We have combined tokenized equity and electronic stock certificate systems that will simplify the transfer of shares.

- Our primary and secondary markets are blockchain friendly which will reduce documents and legal costs when raising capital.

Investment Exchange for the World

Sharevest will remove the need for crowdfunding and peer to peer platforms. Our platform will facilitate every phase in making investment decisions from financial and communications analysis to private equity purchases / sales.

100k

- Sharevest's corporate growth expects to be listed within the next 2 to 3 years.

1 m

- Social investors interact 2 to 3 years into the future.

250 m

- Raised by the company using our exchange for the next 3 to 5 years.

Sales Token Shares

- Token protocol: ETH, ERC20

- Contribution received: ETH

- Value of ICO Round price: 1 SVX = $ 0.20 USD (Twenty cents)

- PRE-ICO price value: 1 SVX = $ 0.13 USD (Thirteen cents)

- Offering Token: 200,000,000 MM (Two Hundred Million)

- Token Symbol: SVX

- Date of ICO: TBA; June July

- Pre-ICO Date: TBA; May June

- Round: 1 Flash Sale Community + 1 Pre-sale + 1 Single Round

- Min / Max Cap CROWDSALE: None / $ 21MM

Allocation of Token

- 60% - Sales Token

- 20% - Initial Investor

- 10% - Tim

- 5% - Referral Incentives

- 3% - Bounty Program

- 2% - Law and Advisor

Use of planned results

- 20% - Engineering and Development

- 20% - Investment Opportunity

- 20% - Operational Expenses

- 20% - Marketing & Sales

- 10% - Partner Engagement

- 10% - Laws & Regulations

Roadmap

- December 2016 - Company established

The Sharevest concept was created after a strategic blockchain meeting with a C-level executive at Credit Suisse.

- April 2017 - Initial Concept

Expert research is done to validate and refine the concept into a viable business model

- June 2017 - Assembled Team

Financial experts and blockchain added to the team

- September 2017 - Partnership confirmed

Partnerships with leading industry providers in finance, corporate law and auditing are in principle approved

- November 2017 - Development Begins

MVP development begins. Architectural design and manufacture of wireframes begins

- January 2018 - Work towards ICO

The first draft of the ICO website and the preparation of the White Paper began

- February 2018 - Alpha Completed

The Alpha version of Sharevest is completed and marks for ICO begins

- March 2018 - ICO preparation is complete

Website, Whitepaper, and Beta uploaded to website

- May 2018 - Sharevest ICO begins

Option to use Ethereum and Bitcoin

- October 2018 - Sharevest ready to launch

The SVX community has the opportunity to view products, test, suggest new features or amendments

- December 2018 - Sharevest is a live broadcast

Sharevest 1.0 was released. Revenue keeps the company growing

- November 2019 - Startup can join

Startup can join Sharevest

- December 2019 - Sharevest exchange conversion token

The SVX Token can be used to own up to 20% of Sharevest shares.

Executive team

- Caleb Barnes-Christian - CEO & Founder

- James Whyte - Chief Economist Strategist

- Michael Christensen - Counselor, CTO

- Hadrien Forterre - CLO

Development team

- Gareth Christodoulou - Frontend Developer

- Harpeet S Chawla - Advisor, Senior Backend Developer

- Chike Chiejine - Full Stack Developer

- Raman Lakhanpal - Front End Developer

Investment Analyst

- Daniel Afan Jones - Adviser, Financial Markets

- Alexander Hein - Advisor, Senior Associate Consultant

- Adam Sosnowski - Financial Analyst

- Matthew Richards - Advisor, Investment Analyst

- Leonardo Fabbri - Securities Analyst

- James MacIntyre - Advisor, Investment, and Risk

Law & Compliance

- Aaron Goddard - Advisor, Regulation & Compliance

- Emily Coles - MiFID II

- Jemes Rasa - Accountant

- Aleksandra Owczarska - Paralegal Finance

Fiat Expert, Blockchain & Crypto

- Benedikt Notheisen - Blockchain and Securities Expert

- Tobi Arayomi - Currency Trading Analyst

- Radchuk Oleksandr - Lead Blockchain

Partnership & Business Development

- Nicholas Thomas - Corporate Social Responsibility

- Gill Wadsworth - Advisor, Business, and Finance

- Saeed Al Azemi - Director of Investment (Middle East & North Africa - EMPEA)

- Campbell Gregory - Partnership and Company

- Adedotun Adesina - Business Analyst

Marketing & PR

- Michael Robinson - Advisor, Marketing & PR

- Ash Stephenson - Community Manager

- George Knight - Digital Marketing and Campaign

- Daniel Penuela - Graphic and Video Marketing

- Anisha Vasudevan - Marketing & PR

Important Links:

- Website: https://www.sharevest.co//

- White Paper: http://sharevest.co/WHITEPAPER.pdf

- Telegram: https://telegram.me/sharevestX

- Twitter: https://twitter.com/sharevestX

- Facebook: https://www.facebook.com/sharevestx/

- Youtube: https://www.youtube.com/channel/UChscpyI-Lu4dHuvylb5cUnQ/featured

- Medium: https://medium.com/@sharevestX

Author by: Hellokitty6

Tidak ada komentar:

Posting Komentar