In developing countries, micro-loans enable poor people to become small businesses and improve their finances. The meaning is to quickly and easily grant small monetary theory to consumers in a short period of time.

In developing countries, micro-loans enable poor people to become small businesses and improve their finances. The meaning is to quickly and easily grant small monetary theory to consumers in a short period of time.In recent years, microfinance has proven effective in providing affordable financial services to the poor of the population. It is also worth noting that many developing countries use microcredit as a useful tool for the maintenance of SMEs. Microfinance is the only way for young entrepreneurs to start their own business or expand existing businesses.

Microfinance services have positive and negative aspects. Benefits to customers are to minimize the time it takes to get paid and to the simplicity and availability of the procedures offered by many financial institutions today. The problem is microcredit - meeting the financial needs of current and current customers.

Speaking of the drawbacks of microcredit, the hired person is worth mentioning, among other things, the lending rate at which the loan problem occurs. Often they exceed a bank percentage in credit dozens. This is related to a number of reasons. First, an important factor in calculating lending rates is the risk of assuming a US financial institution that provides unsecured credit services.

KRIPTON: Africa's first encryption loan service

By -k -l March 21, 2018 #Cryptocurrency #Blockchain #Bitcoin #ICO#Ethereum #BTC #ETH #Bitcointalk

By -k -l March 21, 2018 #Cryptocurrency #Blockchain #Bitcoin #ICO#Ethereum #BTC #ETH #Bitcointalk

In developing countries, micro-loans enable poor people to become small businesses and improve their finances. The meaning is to quickly and easily grant small monetary theory to consumers in a short period of time.

In recent years, microfinance has proven effective in providing affordable financial services to the poor of the population. It is also worth noting that many developing countries use microcredit as a useful tool for the maintenance of SMEs. Microfinance is the only way for young entrepreneurs to start their own business or expand existing businesses.

Microfinance services have positive and negative aspects. Benefits to customers are to minimize the time it takes to get paid and to the simplicity and availability of the procedures offered by many financial institutions today. The problem is microcredit - meeting the financial needs of current and current customers.

Speaking of the drawbacks of microcredit, the hired person is worth mentioning, among other things, the lending rate at which the loan problem occurs. Often they exceed a bank percentage in credit dozens. This is related to a number of reasons. First, an important factor in calculating lending rates is the risk of assuming a US financial institution that provides unsecured credit services.

26993314_848440032015488_5260409820447570189_n.jpg

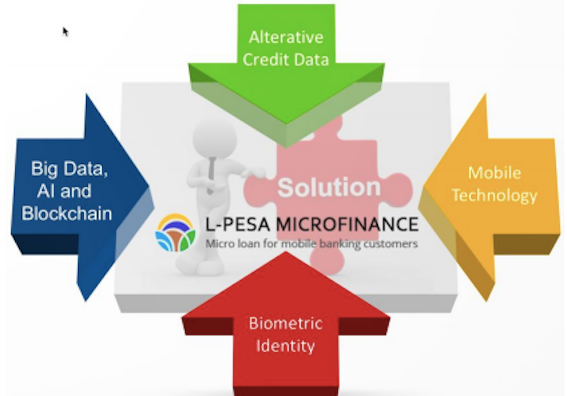

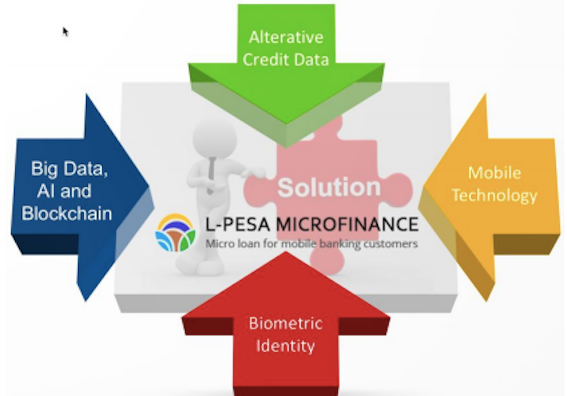

L-Pesa Microfinance is designed to solve many problems in existing micro systems. Reducing the loss factor for credits to less than 10% has become one of the company's most important accomplishments for 12 months. It is a vast success in unsecured consumer loans in any region, but the fact that L-Pesa has reached that fact in East Africa is enormous.

In recent years, microfinance has proven effective in providing affordable financial services to the poor of the population. It is also worth noting that many developing countries use microcredit as a useful tool for the maintenance of SMEs. Microfinance is the only way for young entrepreneurs to start their own business or expand existing businesses.

Microfinance services have positive and negative aspects. Benefits to customers are to minimize the time it takes to get paid and to the simplicity and availability of the procedures offered by many financial institutions today. The problem is microcredit - meeting the financial needs of current and current customers.

Speaking of the drawbacks of microcredit, the hired person is worth mentioning, among other things, the lending rate at which the loan problem occurs. Often they exceed a bank percentage in credit dozens. This is related to a number of reasons. First, an important factor in calculating lending rates is the risk of assuming a US financial institution that provides unsecured credit services.

26993314_848440032015488_5260409820447570189_n.jpg

L-Pesa Microfinance is designed to solve many problems in existing micro systems. Reducing the loss factor for credits to less than 10% has become one of the company's most important accomplishments for 12 months. It is a vast success in unsecured consumer loans in any region, but the fact that L-Pesa has reached that fact in East Africa is enormous.

L-Pesa was created to improve people's lives through efficient access to credit and related financial services. The company started in Tanzania in March 2016 and has already issued over 38,000 credits. Over 170,000 users by social marketing campaigns with a minimum budget. Over time, L-Pesa expects to enter additional financial services to attract the user base, such as deposit transfers.

L-Pesa Microfinance has many distinct advantages.

Blockchain technology provides transparency and efficiency to dramatically reduce operating costs and enable small credits to run. Advances in artificial intelligence have opened new opportunities for the acquisition of autocredit, and new tools enable the maintenance of vast amounts of data.

L-Pesa Microfinance has many distinct advantages.

Blockchain technology provides transparency and efficiency to dramatically reduce operating costs and enable small credits to run. Advances in artificial intelligence have opened new opportunities for the acquisition of autocredit, and new tools enable the maintenance of vast amounts of data.

The originally developed credit model, based on the customer's social network analysis, combines with the traditional and alternative credit data required for future assessments to make decisions about loan acquisitions for customers.

Mobile financial services such as M-Pesa are available in many countries and support both banking and non-banking populations. Based on the market penetration of mobile phones (smartphones and feature phones), mobile call services such as M-Pesa, Tigo Pesa and Paytm have grown, enabling L-Pesa.

With the biometric ID system, you can significantly reduce costs and provide financial services without a physical branch network.

The L-Pesa model is based in part on a trust ladder. Users start with a minimum credit (usually $ 1,00) and get more credit after the microcredit has been successfully repaid. Credit scores are also influenced by other factors such as the completion of personality checks. All the procedures for receiving a loan from L-Pesa are as follows:

The L-Pesa model is based in part on a trust ladder. Users start with a minimum credit (usually $ 1,00) and get more credit after the microcredit has been successfully repaid. Credit scores are also influenced by other factors such as the completion of personality checks. All the procedures for receiving a loan from L-Pesa are as follows:

Users often register their accounts with L-Pesa in response to social media posts or SMS marketing messages. Over time, L-Pesa expects many new statements to be made through the recommendations of existing users.

You add documents to your L-Pesa account that verify your identity, such as your driver's license or passport.

L-Pesa's workforce performs an automatic check of personality.

You will receive an initial application for credit of US $ 1,100. In most cases, this application is automatically approved.

All future loan requests will be processed in the same way. In other words, automation based on the user's credit score is the key to success and expansion.

All future loan requests will be processed in the same way. In other words, automation based on the user's credit score is the key to success and expansion.

Credit authorization is paid in real time using mobile money services such as M-Pesa and Tigo Pesa.

Users are provided to plan payments for credits based on whether they make regular payments. Redemption is done using mobile payments. Postpay affects your credit rating.

Users are provided to plan payments for credits based on whether they make regular payments. Redemption is done using mobile payments. Postpay affects your credit rating.

User support implements the L-Pesa back office team in Tanzania. User support is provided in English and Swahili through social media channels, email and phone.

The mobilization of funding programs Microcredit in developing countries acts as the winning tool for shaping, promoting and strengthening ideology and motivation.

The mobilization of funding programs Microcredit in developing countries acts as the winning tool for shaping, promoting and strengthening ideology and motivation.

L-Pesa will lead the markets that support more than 40% of the earth's population: Africa, the Indian subcontinent and Southeast Asia. The current population exceeds 3 billion people and is growing fast. L-Pesa the mobile decision based on the use of mobile phones. The available L-Pesa market will significantly exceed the creditworthiness of L-Pesa.

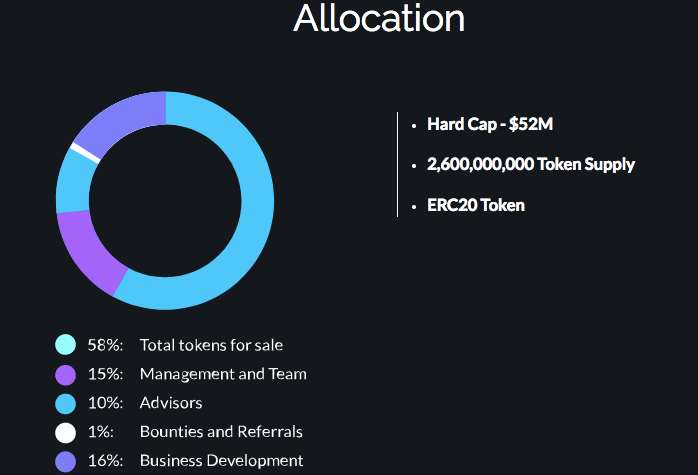

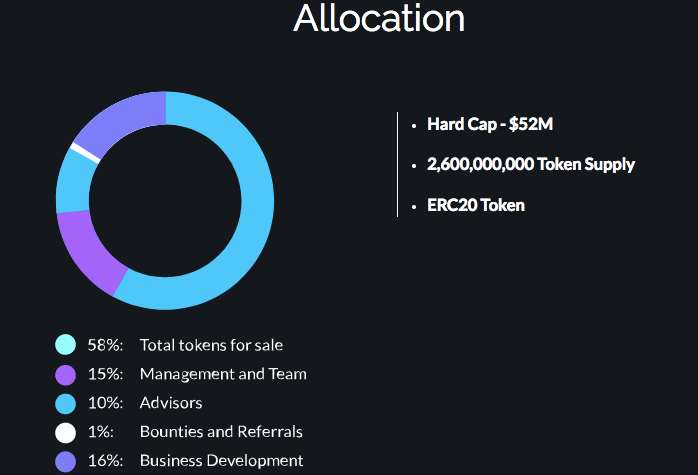

The LPK token is a standard ERC20 marker (on the Ethereum platform) that enables the use of the LPK application. The utility unlocked by the LPK marker is a way to participate in LPK project token offerings to gain access to features that are unlocked only with the usage token unique to the L-Pesa network.

The LPK token is a standard ERC20 marker (on the Ethereum platform) that enables the use of the LPK application. The utility unlocked by the LPK marker is a way to participate in LPK project token offerings to gain access to features that are unlocked only with the usage token unique to the L-Pesa network.

Token Name: KRIPTON

Token Ticker: LPK

Token Type: Ethereum ERC20

Total Token Issued: Maximum 2,600,000,000.

Mining: There should be no mining or other means to increase the token amount and save a second ICO in the future.

Use of Revenue: See the section "Use of Revenues" in this document.

Token Memory: ERC20 kripton tokens are stored in the user's L-Pesa wallet. During the retention period, the user can exchange the ERC20 kripton token at the L-Pesa social exchange.

Pre-sale will begin on 18 March 2018 / 15:00 GMT

Pre-sale will end on 3 April 2018

ICO will begin on 10 April 2018 / 15:00 GMT

ICO will end on 10 May 2018

Website - https://kriptonofafrica.com/

Whitepaper - https://kriptonofafrica.com/static/pdfs/L-Pesa%20ICO%20white%20paper%202018.pd f

BitcoinTalk - https://bitcointalk.org/index.php?topic=2910183.0

Twitter - https://twitter.com/lpesaico

Facebook - https://www.facebook.com/lpesaico

Telegram - https://t.me/lpesaICO

Token Ticker: LPK

Token Type: Ethereum ERC20

Total Token Issued: Maximum 2,600,000,000.

Mining: There should be no mining or other means to increase the token amount and save a second ICO in the future.

Use of Revenue: See the section "Use of Revenues" in this document.

Token Memory: ERC20 kripton tokens are stored in the user's L-Pesa wallet. During the retention period, the user can exchange the ERC20 kripton token at the L-Pesa social exchange.

Pre-sale will begin on 18 March 2018 / 15:00 GMT

Pre-sale will end on 3 April 2018

ICO will begin on 10 April 2018 / 15:00 GMT

ICO will end on 10 May 2018

Website - https://kriptonofafrica.com/

Whitepaper - https://kriptonofafrica.com/static/pdfs/L-Pesa%20ICO%20white%20paper%202018.pd f

BitcoinTalk - https://bitcointalk.org/index.php?topic=2910183.0

Twitter - https://twitter.com/lpesaico

Facebook - https://www.facebook.com/lpesaico

Telegram - https://t.me/lpesaICO

Author by: Hellokitty6

Tidak ada komentar:

Posting Komentar